Sales activity reflects typical seasonality, price gains maintained

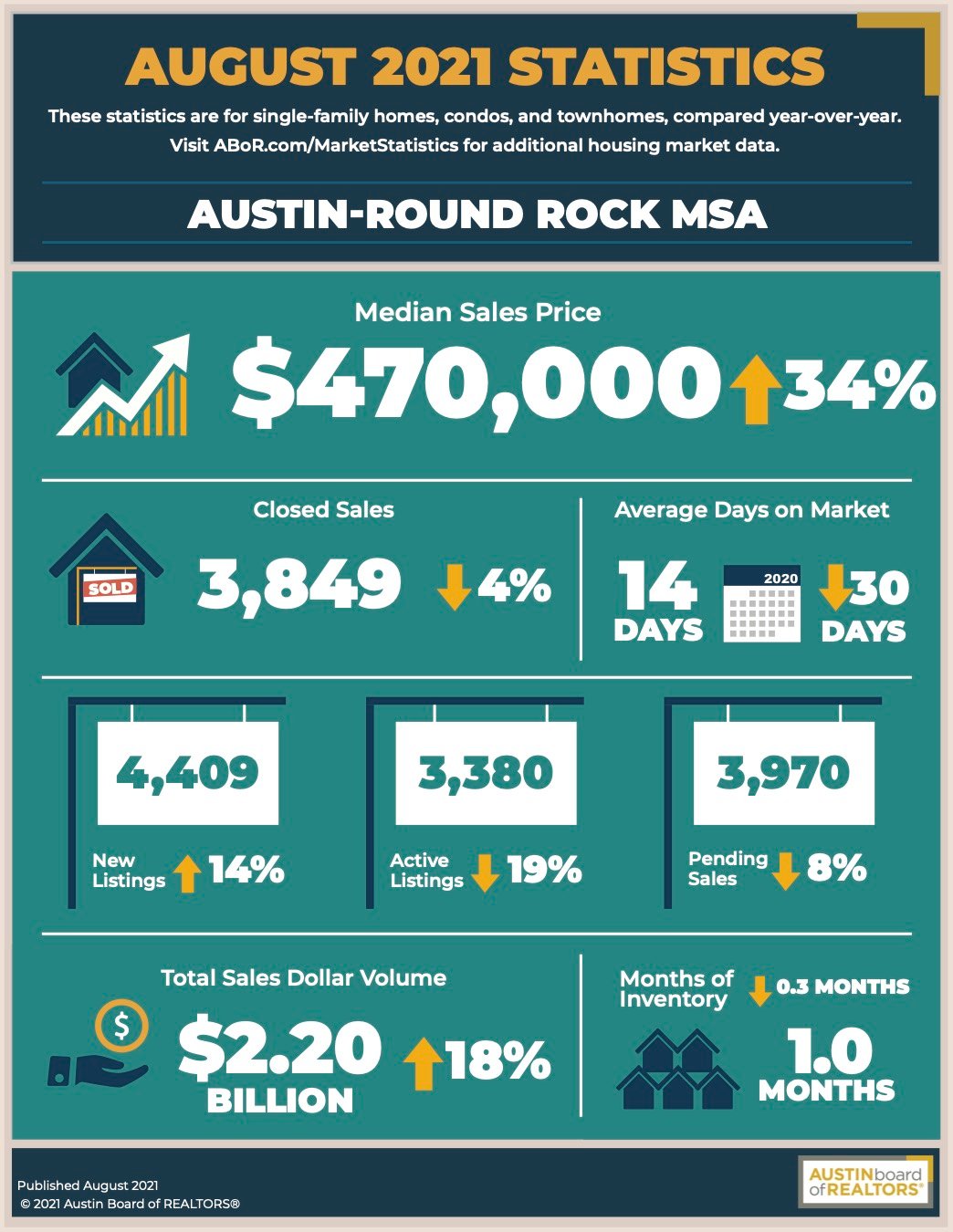

AUSTIN, Texas – According to the Austin Board of REALTORS® (ABoR) August 2021 Central Texas Housing Report, home sales decreased 4.6% compared to August 2020. The data indicates the market is calming as typical seasonality has returned in terms of number of closings, even as median sales prices maintained the gains made over the course of 2021. Despite setting a record for the month of August with a median sales price of $470,000 across the MSA, prices are no longer increasing at a significant rate month to month.

“The region’s housing market is calming compared to the hectic pace experienced at the beginning of the year,” Susan Horton, 2021 ABoR President, said. “While it wouldn’t be appropriate to say market conditions are normalizing – inventory is still at an all-time low and homes are still selling as soon as they hit the market – August’s housing activity is closer to what we would typically experience in the fall. Homebuyers, sellers and renters should work with a REALTOR® who can be a trusted advisor and help them navigate what is still a still very complex process.”

As residential home sales in the Austin Round-Rock MSA declined 4.6% to 3,849, the median sales price jumped 34.7% year over year to $470,000—a record for the month of August. Sales dollar volume increased 18.7% year over year to $2,208,535,793. Monthly housing inventory dipped 0.3 months to 1.0 months of inventory compared to August 2020, the highest level of inventory across the MSA since October 2020.

According to Mark Sprague, economist, and the state director of information capital for Independence Title, Austin’s market is exactly where it should be based on demand.

“There have been reports of Austin’s housing market being overvalued, but from an economist’s perspective, my question is, ‘overvalued compared to what?’ The Austin market is robust, and sales activity and pricing have been driven by true demand. A combination of events, including increased job creation in the market, low interest rates, shifting priorities for perspective buyers, and in many cases, increased personal savings following stay at home orders during COVID, are why the Austin MSA is a top market in the country. When there is this much demand, it is difficult for an entire market to be considered overvalued.”

Sprague pointed to Austin’s economy outperforming most of the nation with job creation and single-family permit applications as key indicators:

“Austin’s economic resiliency has led the MSA to be a leading market in the nation in terms of single-family permit applications for new construction. The national average for permit applications is down 31% compared to peak applications during 2002-2008, but the Austin area is up 28%. The bottom line is that Austin’s market can be challenging, there are still many opportunities to find the right home and build equity.”

Last month, new listings increased 14.1% to 4,409 listings; active listings declined 19.1% year over year to 3,380 listings; and pending sales decreased 8.6% to 3,970 listings. Homes only spent an average of 14 days on market last month across the MSA, a decrease of 30 days from the year prior.

Horton reaffirmed that low inventory and rising home prices will be the status quo for the foreseeable future.

“An increase in permit applications is a positive sign, but we need an all of the above approach to increasing inventory across the region. The Austin Board of REALTORS® is focused on working with our industry and elected officials to find solutions to expedite the development process to offer more opportunities for housing. Doing this will help us maintain our comparatively affordable edge when it comes to cost of living and of course, allow people to continue to enjoy the quality of life in the region that has made it so attractive for decades.”

City of Austin

In August, home sales ticked up 0.2% to 1,244 sales, while the median home price rose 27.1% year over year to $540,000—a record for the month of August. During the same period, sales dollar volume increased 20.9% to $812,406,833 as new listings increased 2.7% to 1,345 listings. Compared to August 2020, active listings dropped 27.7% to 1,048 listings, and pending sales decreased 6.9% to 1,201 pending sales. Monthly housing inventory decreased 0.5 months year over year to 0.9 months of inventory.

Travis County

In Travis County, home sales also decreased 3.7% to 1,935 sales, and sales dollar volume climbed 10.7% to $1,278,954,470. The median sales price increased 25.5% year over year to $527,000 as new listings increased 4.7% to 2,134 listings and active listings declined 22.1% to 1,728 listings. Compared to August 2020, pending sales decreased 11.4% to 1,914 pending sales as the inventory decreased 0.4 months year over year to 1.0 months of inventory.

Williamson County

In August in Williamson County, home sales decreased 4.2% to 1,314 sales, while sales dollar volume increased 36.6% to $642,737,607. Median prices rose 46.6% to $441,000, and new listings climbed 23.6% to 1,434 listings. During the same period, active listings declined 7.4% to 1,005 listings, and pending sales fell 6.3% to 1,348 pending sales. Housing inventory ticked down 0.1 months year over year to 0.9 months of inventory.

Hays County

Last month, home sales decreased 10.5% to 437 sales as sales dollar volume climbed 21.2% to $225,932,518 in Hays County. The median price for homes increased 30.3% to $399,000 as new listings rose 31% to 625 listings. Active listings decreased 16.4% to 460 listings while pending sales decreased 3.5% to 521 pending sales. Housing inventory decreased 0.3 months to 1.0 months of inventors.